|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

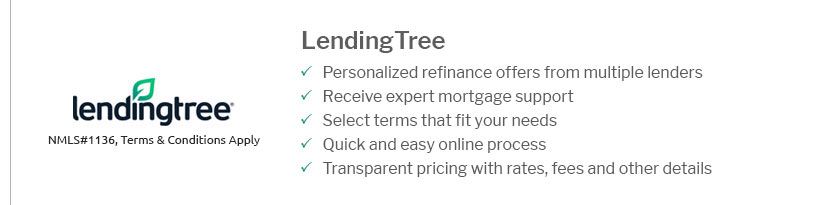

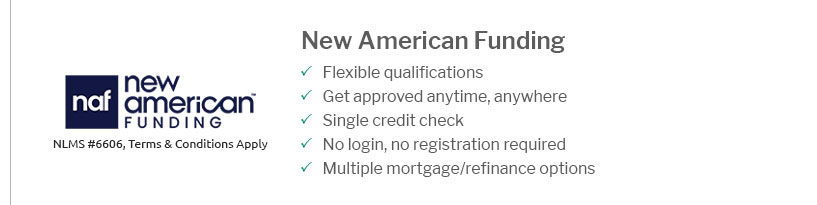

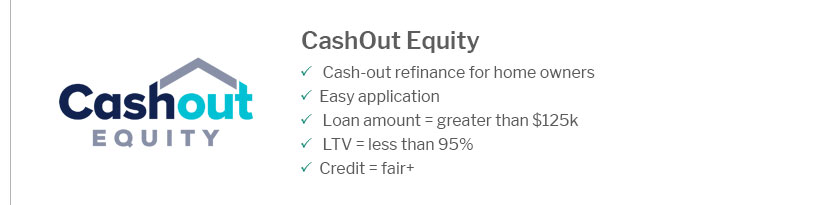

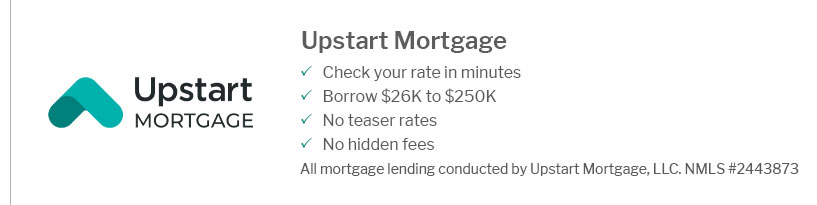

Who to Refinance Home With: Choosing the Right Lender for Your NeedsRefinancing your home can be a strategic financial move, but choosing the right lender is crucial. This article will guide you through the options available and help you make an informed decision. Understanding the Basics of Home RefinancingRefinancing involves replacing your current mortgage with a new one, often to secure a lower interest rate or adjust the loan term. The right lender can offer competitive rates and favorable terms. Types of LendersSeveral types of lenders are available for home refinancing, each offering distinct advantages and considerations.

Factors to Consider When Choosing a LenderWhen deciding who to refinance home with, consider these key factors: Interest Rates and FeesLook for lenders offering the best rates and transparent fee structures. It's crucial to compare options to ensure you're getting the best deal possible. Customer ServiceExcellent customer service can make the refinancing process smoother and less stressful. Choose a lender with a strong reputation for responsiveness and support. Loan TermsConsider the loan terms that best fit your financial goals, such as a shorter or longer repayment period. Online resources can help you compare best home refinance rates arizona for more insights. Top Lenders for Home RefinancingWhile there are many lenders to consider, some have established themselves as leaders in the refinancing market.

Researching and comparing best home refinance rates california can further aid in making the best choice for your needs. Frequently Asked QuestionsWhat is the best way to compare refinance lenders?Start by comparing interest rates, fees, and customer reviews. Utilize online tools and calculators to analyze different offers and select the most favorable terms. Can I refinance my home with a poor credit score?Yes, but it may be more challenging. Some lenders specialize in working with individuals with lower credit scores, though the rates may be higher. Choosing the right lender for refinancing your home requires careful consideration of various factors, from interest rates to customer service. By understanding your options and conducting thorough research, you can secure a favorable refinancing deal that aligns with your financial goals. https://www.bankrate.com/mortgages/best-lenders/refinance-mortgage-lenders/

We've made it easier for you to compare refinance offers by reviewing dozens of mortgage lenders in several key areas. https://www.cnbc.com/select/best-mortgage-refinance-lenders/

CNBC Select has chosen the best lenders for a refinance mortgage in a number of categories. (See our methodology for more on how we made our selections.) https://myhome.freddiemac.com/refinancing/options-for-refinancing

If you're thinking about a cash-out refinance for home ...

|

|---|